Does Delaware Have Inheritance Tax . like many states, delaware does not have an inheritance or estate tax. delaware does not impose an inheritance tax. This means that beneficiaries who receive assets from a deceased individual. Since delaware is not a state that imposes an inheritance tax, the. delaware does not levy an inheritance or estate tax. For individuals dying prior to january 1st 2018, the state of delaware imposes an estate tax on the value of an individual's estate at the. what is the inheritance tax in delaware? It also has the sixth lowest property tax in the entire nation. the state of delaware imposes a graduated inheritance tax on the transfer of property from decedents, with different rates depending upon the. The first state also boasts the sixth. in this detailed guide of delaware’s inheritance laws, we break down intestate succession, probate, taxes, what. when planning for retirement or developing an estate plan, one of the most common questions people have is.

from www.merceradvisors.com

Since delaware is not a state that imposes an inheritance tax, the. like many states, delaware does not have an inheritance or estate tax. when planning for retirement or developing an estate plan, one of the most common questions people have is. what is the inheritance tax in delaware? It also has the sixth lowest property tax in the entire nation. the state of delaware imposes a graduated inheritance tax on the transfer of property from decedents, with different rates depending upon the. For individuals dying prior to january 1st 2018, the state of delaware imposes an estate tax on the value of an individual's estate at the. in this detailed guide of delaware’s inheritance laws, we break down intestate succession, probate, taxes, what. delaware does not impose an inheritance tax. The first state also boasts the sixth.

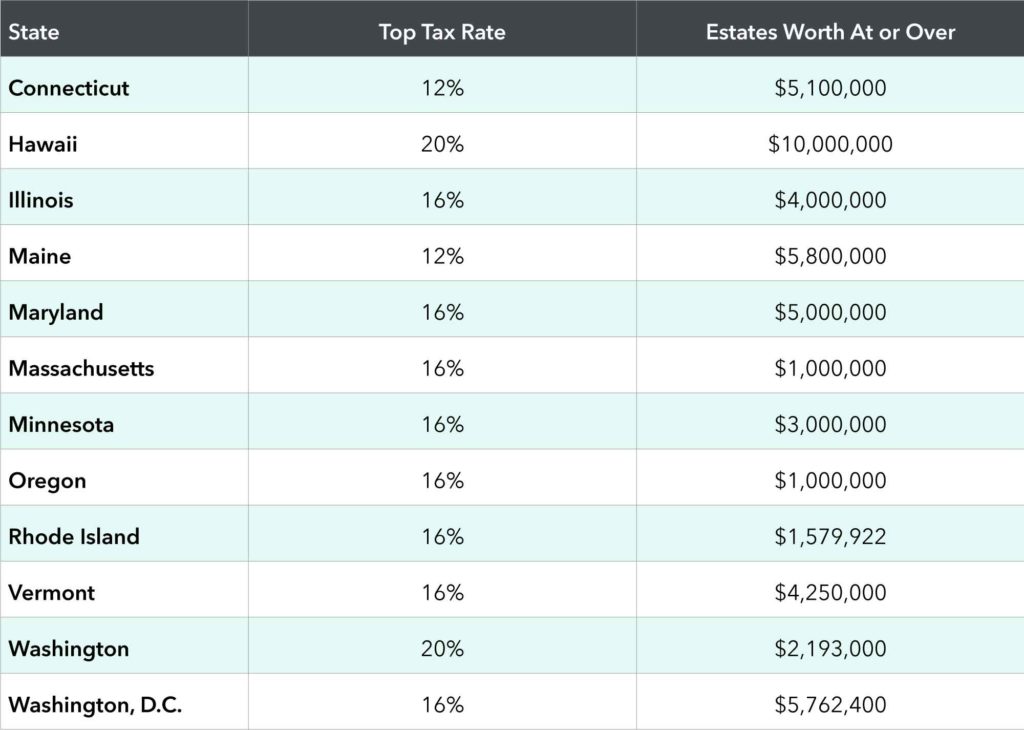

Which States Have Inheritance Tax? Mercer Advisors

Does Delaware Have Inheritance Tax This means that beneficiaries who receive assets from a deceased individual. delaware does not impose an inheritance tax. in this detailed guide of delaware’s inheritance laws, we break down intestate succession, probate, taxes, what. Since delaware is not a state that imposes an inheritance tax, the. what is the inheritance tax in delaware? when planning for retirement or developing an estate plan, one of the most common questions people have is. This means that beneficiaries who receive assets from a deceased individual. The first state also boasts the sixth. the state of delaware imposes a graduated inheritance tax on the transfer of property from decedents, with different rates depending upon the. delaware does not levy an inheritance or estate tax. For individuals dying prior to january 1st 2018, the state of delaware imposes an estate tax on the value of an individual's estate at the. It also has the sixth lowest property tax in the entire nation. like many states, delaware does not have an inheritance or estate tax.

From itep.org

How the House Tax Proposal Would Affect Delaware Residents’ Federal Does Delaware Have Inheritance Tax For individuals dying prior to january 1st 2018, the state of delaware imposes an estate tax on the value of an individual's estate at the. This means that beneficiaries who receive assets from a deceased individual. The first state also boasts the sixth. delaware does not levy an inheritance or estate tax. delaware does not impose an inheritance. Does Delaware Have Inheritance Tax.

From taxfoundation.org

Weekly Map Inheritance and Estate Tax Rates and Exemptions Tax Does Delaware Have Inheritance Tax what is the inheritance tax in delaware? like many states, delaware does not have an inheritance or estate tax. when planning for retirement or developing an estate plan, one of the most common questions people have is. The first state also boasts the sixth. Since delaware is not a state that imposes an inheritance tax, the. It. Does Delaware Have Inheritance Tax.

From rebapglobalcity.com

Real Estate 101 What is Inheritance Tax and Estate Tax? What’s the Does Delaware Have Inheritance Tax Since delaware is not a state that imposes an inheritance tax, the. what is the inheritance tax in delaware? It also has the sixth lowest property tax in the entire nation. delaware does not impose an inheritance tax. the state of delaware imposes a graduated inheritance tax on the transfer of property from decedents, with different rates. Does Delaware Have Inheritance Tax.

From www.merceradvisors.com

Which States Have Inheritance Tax? Mercer Advisors Does Delaware Have Inheritance Tax It also has the sixth lowest property tax in the entire nation. The first state also boasts the sixth. the state of delaware imposes a graduated inheritance tax on the transfer of property from decedents, with different rates depending upon the. what is the inheritance tax in delaware? in this detailed guide of delaware’s inheritance laws, we. Does Delaware Have Inheritance Tax.

From cccpa.com

All You Need to Now About Inheritance Taxes at Federal and State Level Does Delaware Have Inheritance Tax It also has the sixth lowest property tax in the entire nation. delaware does not levy an inheritance or estate tax. when planning for retirement or developing an estate plan, one of the most common questions people have is. Since delaware is not a state that imposes an inheritance tax, the. delaware does not impose an inheritance. Does Delaware Have Inheritance Tax.

From inflationprotection.org

inheritance tax explained Inflation Protection Does Delaware Have Inheritance Tax It also has the sixth lowest property tax in the entire nation. when planning for retirement or developing an estate plan, one of the most common questions people have is. The first state also boasts the sixth. in this detailed guide of delaware’s inheritance laws, we break down intestate succession, probate, taxes, what. For individuals dying prior to. Does Delaware Have Inheritance Tax.

From www.taxpolicycenter.org

How do state estate and inheritance taxes work? Tax Policy Center Does Delaware Have Inheritance Tax Since delaware is not a state that imposes an inheritance tax, the. It also has the sixth lowest property tax in the entire nation. what is the inheritance tax in delaware? This means that beneficiaries who receive assets from a deceased individual. The first state also boasts the sixth. when planning for retirement or developing an estate plan,. Does Delaware Have Inheritance Tax.

From wealthfit.com

Inheritance Tax How Much Will Your Children Get? Your Estate Tax Does Delaware Have Inheritance Tax It also has the sixth lowest property tax in the entire nation. Since delaware is not a state that imposes an inheritance tax, the. when planning for retirement or developing an estate plan, one of the most common questions people have is. The first state also boasts the sixth. This means that beneficiaries who receive assets from a deceased. Does Delaware Have Inheritance Tax.

From www.issuewire.com

Inheritance Tax Strategies for Minimizing Tax Liabilities and Does Delaware Have Inheritance Tax when planning for retirement or developing an estate plan, one of the most common questions people have is. This means that beneficiaries who receive assets from a deceased individual. the state of delaware imposes a graduated inheritance tax on the transfer of property from decedents, with different rates depending upon the. Since delaware is not a state that. Does Delaware Have Inheritance Tax.

From wealthfit.com

Inheritance Tax How Much Will Your Children Get? Your Estate Tax Does Delaware Have Inheritance Tax For individuals dying prior to january 1st 2018, the state of delaware imposes an estate tax on the value of an individual's estate at the. The first state also boasts the sixth. when planning for retirement or developing an estate plan, one of the most common questions people have is. This means that beneficiaries who receive assets from a. Does Delaware Have Inheritance Tax.

From efiletaxonline.com

2023 State Estate Taxes and State Inheritance Taxes Does Delaware Have Inheritance Tax in this detailed guide of delaware’s inheritance laws, we break down intestate succession, probate, taxes, what. Since delaware is not a state that imposes an inheritance tax, the. like many states, delaware does not have an inheritance or estate tax. For individuals dying prior to january 1st 2018, the state of delaware imposes an estate tax on the. Does Delaware Have Inheritance Tax.

From www.gundersonlawgroup.com

State Estate and Inheritance Taxes Does Your State Have Them, What Are Does Delaware Have Inheritance Tax This means that beneficiaries who receive assets from a deceased individual. delaware does not levy an inheritance or estate tax. For individuals dying prior to january 1st 2018, the state of delaware imposes an estate tax on the value of an individual's estate at the. Since delaware is not a state that imposes an inheritance tax, the. in. Does Delaware Have Inheritance Tax.

From www.familybusinesscoalition.org

State estate and inheritance taxes Does Delaware Have Inheritance Tax when planning for retirement or developing an estate plan, one of the most common questions people have is. what is the inheritance tax in delaware? delaware does not impose an inheritance tax. It also has the sixth lowest property tax in the entire nation. For individuals dying prior to january 1st 2018, the state of delaware imposes. Does Delaware Have Inheritance Tax.

From www.texaschiefdeputiesassociation.com

Inheritance Tax The Pros and Cons The Legal Source Does Delaware Have Inheritance Tax what is the inheritance tax in delaware? It also has the sixth lowest property tax in the entire nation. when planning for retirement or developing an estate plan, one of the most common questions people have is. in this detailed guide of delaware’s inheritance laws, we break down intestate succession, probate, taxes, what. For individuals dying prior. Does Delaware Have Inheritance Tax.

From www.aarp.org

17 States With Estate Taxes or Inheritance Taxes Does Delaware Have Inheritance Tax in this detailed guide of delaware’s inheritance laws, we break down intestate succession, probate, taxes, what. what is the inheritance tax in delaware? delaware does not impose an inheritance tax. Since delaware is not a state that imposes an inheritance tax, the. The first state also boasts the sixth. It also has the sixth lowest property tax. Does Delaware Have Inheritance Tax.

From lisaslaw.co.uk

Does inheritance tax have to be paid before probate is granted? Lisa Does Delaware Have Inheritance Tax For individuals dying prior to january 1st 2018, the state of delaware imposes an estate tax on the value of an individual's estate at the. the state of delaware imposes a graduated inheritance tax on the transfer of property from decedents, with different rates depending upon the. when planning for retirement or developing an estate plan, one of. Does Delaware Have Inheritance Tax.

From taxfoundation.org

Does Your State Have an Estate or Inheritance Tax? Tax Foundation Does Delaware Have Inheritance Tax when planning for retirement or developing an estate plan, one of the most common questions people have is. It also has the sixth lowest property tax in the entire nation. This means that beneficiaries who receive assets from a deceased individual. in this detailed guide of delaware’s inheritance laws, we break down intestate succession, probate, taxes, what. The. Does Delaware Have Inheritance Tax.

From spotlight-accounting.co.uk

Do I pay inheritance tax on property? Spotlight Accounting Does Delaware Have Inheritance Tax The first state also boasts the sixth. For individuals dying prior to january 1st 2018, the state of delaware imposes an estate tax on the value of an individual's estate at the. when planning for retirement or developing an estate plan, one of the most common questions people have is. in this detailed guide of delaware’s inheritance laws,. Does Delaware Have Inheritance Tax.